Wyomissing Elder Law & Medicaid Planning Attorney

Long-term care can be expensive, and many families worry about how to afford it without losing everything they’ve worked for. At Kozloff Stoudt Attorneys, we help seniors and their loved ones find legal solutions to protect their savings while ensuring access to necessary care. Medicaid can cover nursing home costs, but qualifying isn’t always straightforward. Without proper planning, families may face unnecessary financial strain. Taking steps now can help secure your future, giving you and your family confidence in the years ahead.

Kozloff Stoudt Attorneys proudly hosts one of only two Certified Elder Law Attorneys (CELA) in Berks County, and one of approximately 75 CELAs statewide. This unique credential reflects our dedication and strength in elder law.

Understanding Elder Law and Medicaid

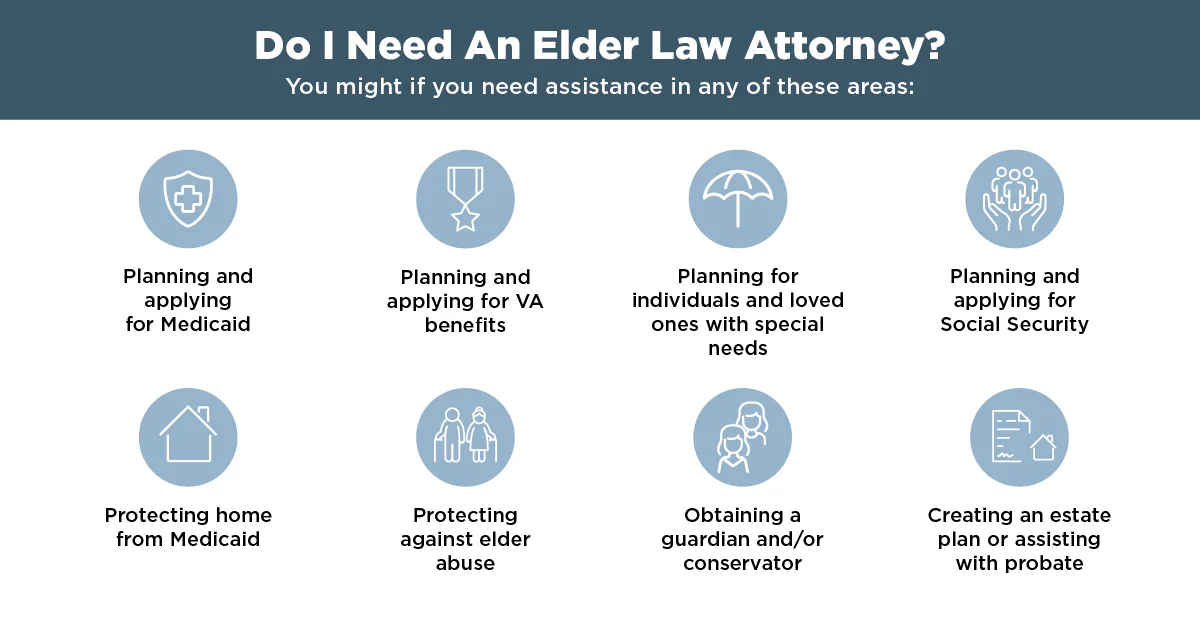

Elder law focuses on legal issues that affect older adults, including long-term care planning, asset protection, and healthcare decisions. As people age, they often face complex challenges that require careful planning to avoid financial hardship and ensure quality care.

Medicaid is key in covering long-term care costs, but qualifying for benefits requires meeting strict income and asset limits. Many families assume they must deplete their savings before becoming eligible, but legal strategies can help preserve assets while still qualifying for assistance.

Without proper planning, the cost of nursing home care can quickly drain a lifetime of savings. Medicaid provides relief, but the rules can be difficult to understand. At Kozloff Stoudt, we help seniors and their families make informed choices about long-term care and financial security. With the right approach, you can access the care you need while protecting what matters most.

Protecting Your Assets While Qualifying for Medicaid

One of the biggest concerns for many families is how to qualify for Medicaid without losing their home or life savings. Medicaid has strict income and asset limits, but there are legal strategies that allow you to protect what you’ve built while still meeting eligibility requirements.

Certain assets, such as a primary residence, may be exempt under Medicaid rules, but financial planning is still necessary to avoid penalties or delays in coverage. Options like irrevocable trusts, Medicaid-compliant annuities, and asset transfers—if done correctly—can help you qualify without spending down everything you own.

Timing is critical. Making financial moves too close to applying for Medicaid could trigger penalties, leaving you responsible for long-term care costs. At Kozloff Stoudt, we work with you to develop a strategy that aligns with your goals. With the right plan, you can secure the care you need while protecting your financial future.

Medicaid Planning Strategies for Long-Term Care

Planning ahead can make a significant difference when it comes to qualifying for Medicaid and preserving your assets. Without a strategy, families may be forced to pay out of pocket for nursing home care, which can quickly deplete savings. Fortunately, several legal tools can help you maintain financial security while ensuring access to long-term care.

Some effective Medicaid planning strategies include:

- Medicaid Asset Protection Trusts (MAPTs): These irrevocable trusts allow you to transfer assets while maintaining Medicaid eligibility.

- Spend-down strategies: Certain expenses, such as home modifications or medical costs, can be used to reduce countable assets.

- Income-producing annuities: Converting assets into income streams can help a spouse retain financial stability while the other spouse qualifies for Medicaid.

- Gifting and transfers: Properly timed gifts can help protect assets, but transfers within Medicaid’s look-back period can result in penalties.

At Kozloff Stoudt, we help you explore options that fit your needs, ensuring long-term care is accessible without unnecessary financial loss.

How We Can Help You and Your Family

Medicaid rules can be complex, and without careful planning, families may face unexpected costs or delays in securing benefits. At Kozloff Stoudt, we take the time to understand your situation and provide legal strategies that protect your assets while ensuring access to long-term care. Our elder law team is actively involved with leading organizations like the National Elder Law Foundation (NELF) and the National Association of Elder Law Attorneys (NAELA), ensuring we remain up-to-date with the latest planning strategies and legal solutions.

Whether you’re planning years in advance or need immediate assistance, we offer guidance tailored to your needs. By addressing issues such as asset protection, Medicaid applications, and long-term care planning, we can help ease the burden.

Contact Our Experienced Berks County Elder Law & Medicaid Planning Attorneys

Planning for long-term care can feel overwhelming, but the right approach can protect your future and your family’s financial well-being. Contact our experienced attorneys today—William Blumer, Julie Pandich, Andrew George, and Brian F. Boland— to discuss your options and create a strategy that works for you.